Business Insurance in and around Tampa

Looking for small business insurance coverage?

Cover all the bases for your small business

Help Protect Your Business With State Farm.

Whether you own a a bakery, a cosmetic store, or a pharmacy, State Farm has small business coverage that can help. That way, amid all the various options and decisions, you can focus on your next steps.

Looking for small business insurance coverage?

Cover all the bases for your small business

Get Down To Business With State Farm

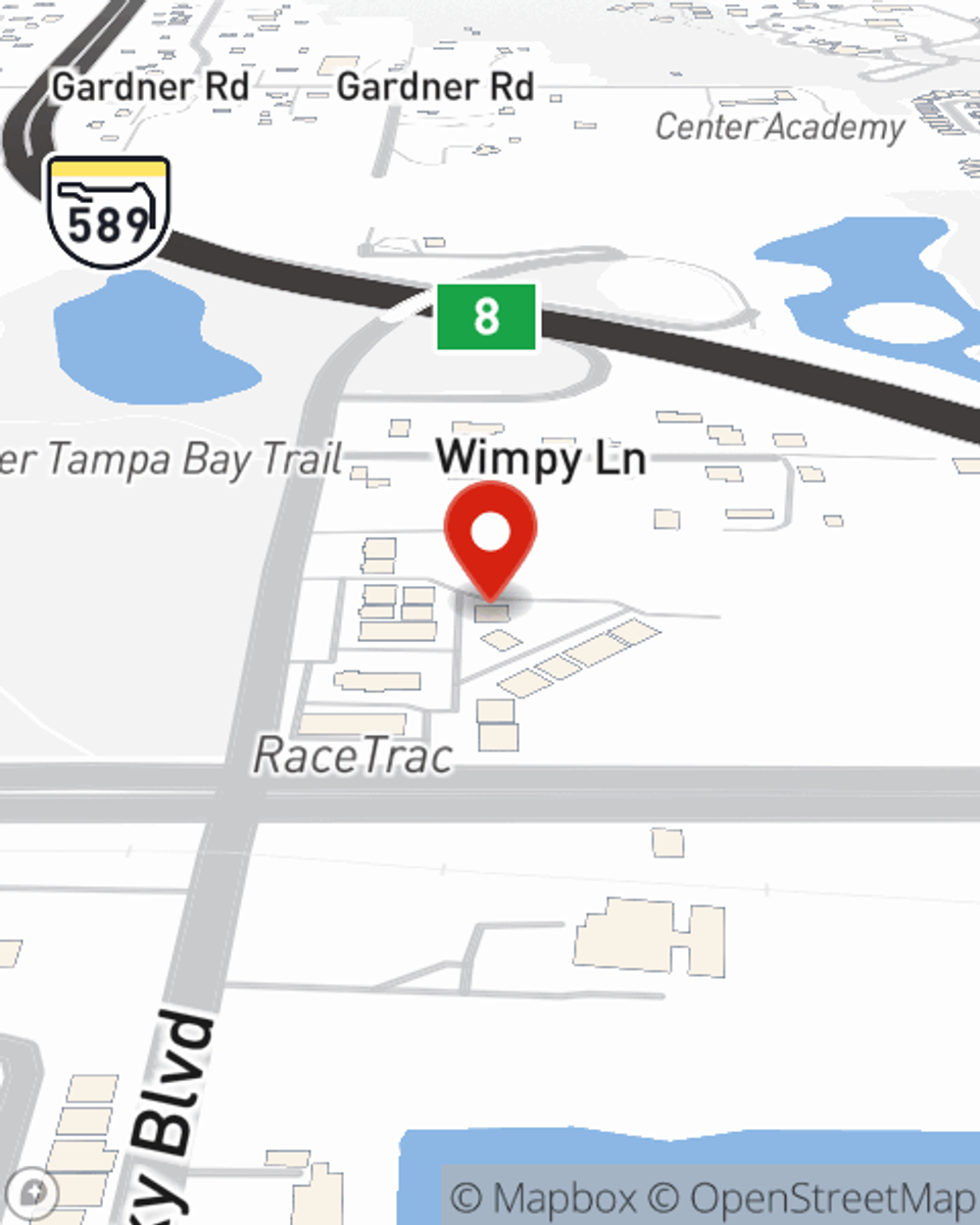

The passion you have to serve your customers is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Pam Williams. With an agent like Pam Williams, your coverage can include great options, such as commercial auto, worker’s compensation and artisan and service contractors.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Pam Williams is here to help you review your options. Reach out today!

Simple Insights®

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Pam Williams

State Farm® Insurance AgentSimple Insights®

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.